Instructions

========

INSTALLATION: Shutdown MetaTrader if it is running. Copy the mq4 file to Program Files/(MetaTrader4 directory)/experts. Copy the Fonts in the zip file to C:/Windows/Fonts.

Then start MetaTrader and open MetaEditor. In the Navigator window on the right double-click FX Multi-Meter II to open it. Press the Compile button and go back to MetaTrader.

In the Navigator window on the left open the experts folder and drag Multi-Meter across onto a chart. The Options panel will come up where the settings can be changed, click

Ok and your'e done. Compiling only needs doing once.

------------------------------------------------------------------------------------------------------

Options

========

NOTE: To access the Options (Inputs) for Multi-Meter without reloading it, change to the Monthly timeframe and press F7. By default Multi-Meter has been disabled on the Monthly

timeframe for this purpose because the code runs an infinite loop which does not normally allow the access of Options from a chart display. To counteract this the loop must be

broken temporarily, in this case the Monthly chart has been set to break the loop and Multi-Meter will not function on this chart by default, but this setting can be changed in the

Options panel.

HISTORY LINE - Enables or disables the History Line. When Multi-Meter is first loaded onto chart you will see the History Line appear slightly ahead of the current time.

Double click on it and drag it across the previous bars to bring up the previous indicator values in Multi-Meter. You can delete the line at any time, but changing timeframes will make

a new one appear (only if one is not present). As long as the Histroy Line is ahead of the current price the current readings will be given, so if you're not using it its best to delete it

until you need it again, otherwise it will soon fall behind current time. It is still not perfect and misses bars past the weekend mark, but is quite accurate for short term history. It is

more accurate reading the current indicators than the multi-timeframe indicators.

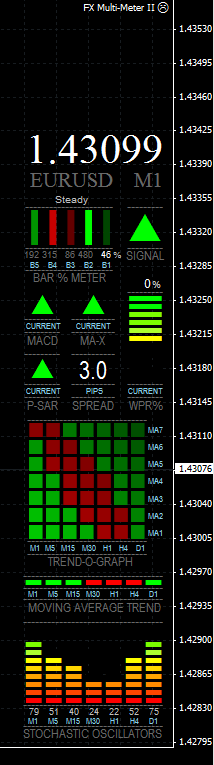

COMPACT MODE - Switches from the default full display to a smaller display that resembles Multi-Meter v.1. The Trend Graph or the OB/OS Signal Map are not available in compact mode.

DISPLAY PRICE/CHART/CURRENCY - The Price/Chart/Currency display can be turned on or off, font size and colour are customizable.

USE MONTHLY CHART FOR OPTIONS - DisableMonthly disables Multi-Meter on the Monthly chart so that Options can be accessed by pressing F7, or from the Expert Advisors menu.

PROCESSING LATENCY (SLEEP) - This is the value in milliseconds that the program loop is stopped before restarting the cycle. Default is 100. It can be adjusted for optimizing the Meter

to your computer. You can reduce the value for slightly more responsiveness of Multi-Meter but go too low and it will start flickering.

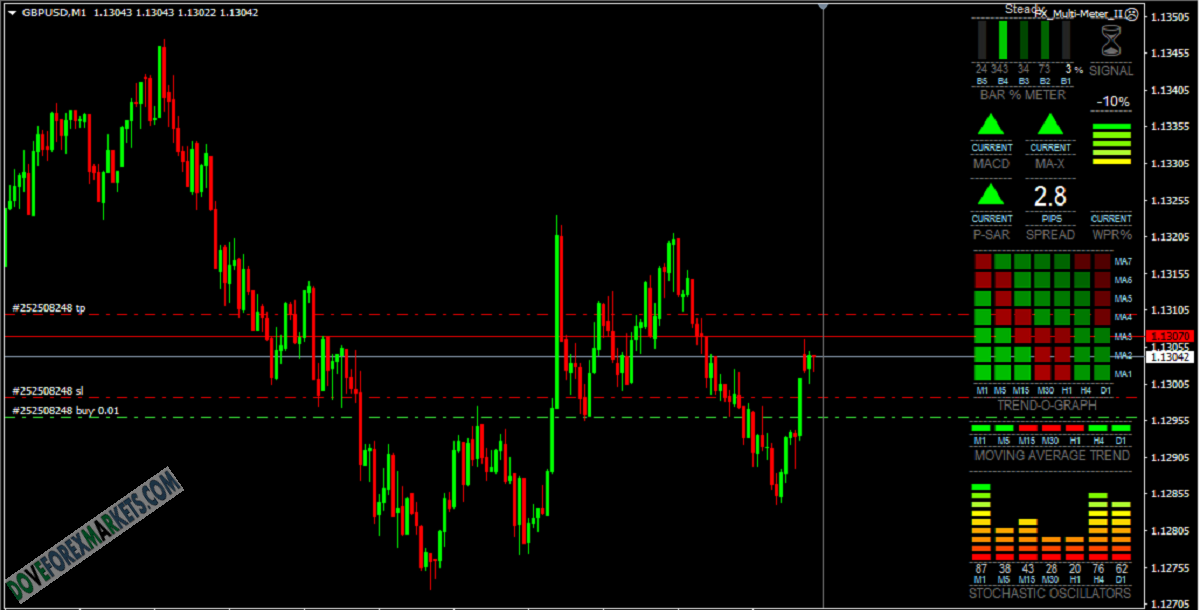

TREND-O-GRAPH - This graph shows trend waves of the short and longer term trend. Use DisplayTrendGraph to toggle between the Trend Graph and OB/OS Signal Map. The Trend Graph

is displayed by default. The values for the 7 Moving Averages can be set here including the MA Type (Simple, Exponential, Smoothed or Linear Weighted). Default is Smoothed.

OVERALL SIGNAL - The overall Signal can be configured to include or exclude the direction of most of the indicators displayed. Current indicators are from the current chart and Multi-timeframe

indicators are the MAs from the Trend Bar. Choose which of these signals you want to include or exclude. By default ALL Current indicators and NO Multi indicators determine the signal.

OB/OS SIGNAL MAP - This graph displays 7 indicators plotted along 7 timeframes. All of them except Bollinger Bands are Oscillators, and are commonly used for identifying Overbought/Oversold

conditions. The indicators are from bottom to top: MACD, Stochastic Oscillator, William's % Range, Money Flow Index, Commodity Channel Index, Relative Strength Index and Bollinger Bands.

If the price moves into an OB or OS zone a grey cross will appear indicating a reversal is imminent. When the the price does reverse the cross will become Green for Buy or Red for Sell.

The more crosses the better if you a trading a reversal, as the OB or OS level is more significant. The zone values are customizable, the default values are the most commonly used.

The OB/OS Signal Map should be used when the market is ranging sideways, as Oscillators are not very reliable in strong trends. NOTE: The MACD Buy or Sell signal is the MACD crossing the

signal line, a grey cross appears if the MACD is falling above the signal line, or rising below the signal line. The Bollinger Bands give a grey signal if the price has moved outside of the bands,

if the price reverses the Buy

or Sell signal is displayed.

INDICATOR VALUES - Values here are for changing the MA-Xover signal, MACD signal, Parabolic SAR signal, MA Trend Bar, W%R and Stochastics.

Interpretation of the Signals

As Multi-Meter is a direct display of various indicators, the principles of each should be reviewed to get a good idea of how to interpret them.

The Bar % Meter is similar to the Rate Of Change indicator. Overall Signal in the top right corner can be set with different basic conditions.

A few minutes with the History Line should show you more than I need explain here but a basic approach to reading the Meter is as follows...

A simpler approach might be... if everything is Green, BUY, if everything is Red, SELL.

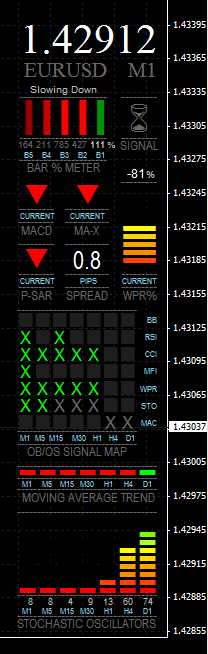

Example interpretation for Reversal Trade setup.

- OB/OS signal Map indicates an extremely Oversold condition on M1 to H1 charts. Recommends BUY.

- Bar % Meter is showing that the strong bearish price movement is slowing down and beginning to move up.

- MACD is heading downwards.

- MA-X is showing that the fast moving 3-period Linear Weighted MA is below the slower 5-period Simple MA.

- P-SAR is still travelling downwards and hasn't swung around yet. The trend is not yet broken.

- WPR% is in Oversold territory.

- All MA's except D1 timeframe are trending downwards.

- Stochastic Oscillator on 5 timeframes are at rock bottom, indicating an extremely Oversold price condition.

- Current spread is 0.8 pips. Nice!

- Overall Signal = Wait (before confirmation to Buy)

Subscribe to access unlimited downloads of Forex Indicators, Forex Robots, Forex Trading Strategies, Forex Source Codes and much more premium tools...

Published:

31 Dec, 2024 06:26 PM

Version:

v2.0

Category:

Instructions Included:

YesSource Code Included:

YesFiles Included:

YesTags: